The World's Oil Supply, Production and Pollution

1. Production

We have been using petroleum based oil for over 150 years, and the extent of the world's oil reserves on land is quite well known. The additional oil found under the oceans is less well mapped, but rapidly being understood. The surprise of the last 5 years has been that we can economically extract oil from the massive shale deposits in the US and elsewhere. Techniques similar to those use for extracting natural gas, horizontal drilling and fracking, have proved amazingly successful in extracting much more viscous oil. Although this process has only begin, in the US we are already seeing a significant increase in our domestic oil supply.

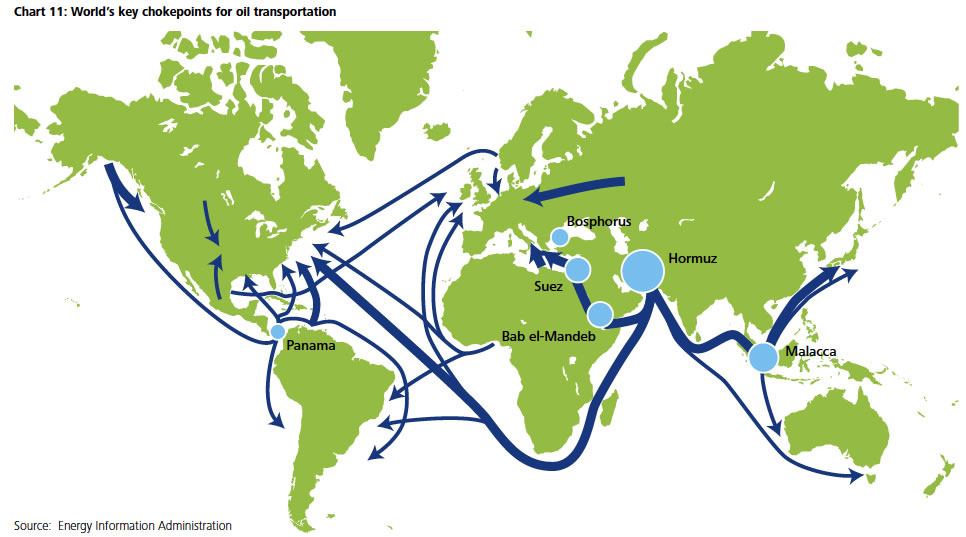

To date however, the majority of our oil comes from wells that are in relatively few places. The map below shows the major oil routes around the world and the chokepoints for oil transportation.

An increasing amount of the oil is being obtained from offshore wells. Massive drilling rigs like the one below are needed.

An increasing amount of the oil is being obtained from offshore wells. Massive drilling rigs like the one below are needed.

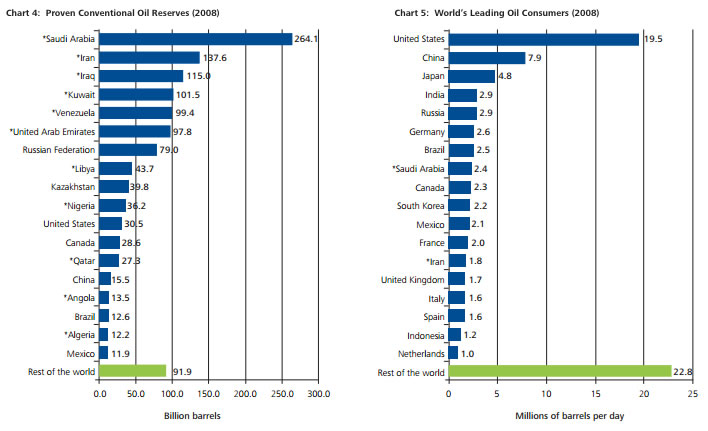

The distribution by country and the usage by country are shown below.

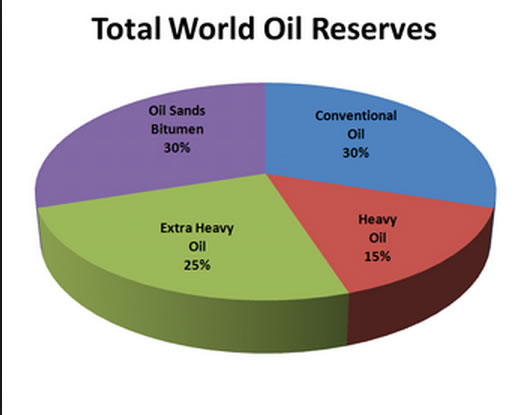

It is most important to note that by far the majority of the oil that will fuel our near future is difficult, expensive oil. As the chart shows oil sands, extra heavy oil and heavy oil constitute 70% of the available reserves.

It is most important to note that by far the majority of the oil that will fuel our near future is difficult, expensive oil. As the chart shows oil sands, extra heavy oil and heavy oil constitute 70% of the available reserves.

In our discussion below we will not focus on the available middle eastern supplies. Rather we will look at the remainder of the world, which is emerging as the new oil supplier, and will certainly be the key suppliers as middle eastern oil supplies dwindle.

North America

Canada

The story is about tar sands and the cooking of oil from them. There are a hugh amount of tar sands in Canada, covering a land area the size of the British Isles. But the stuff has to be cooked to bring it to the composition of 'very' crude oil as it needs another million years in the earth for it to naturally be 'crude oil'. This is very expensive and very energy intensive and very dirty to do. More later.

United States

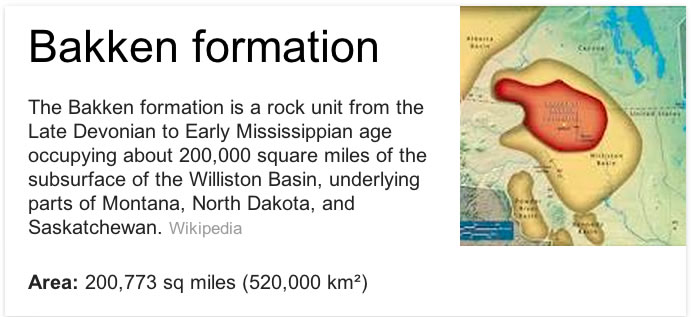

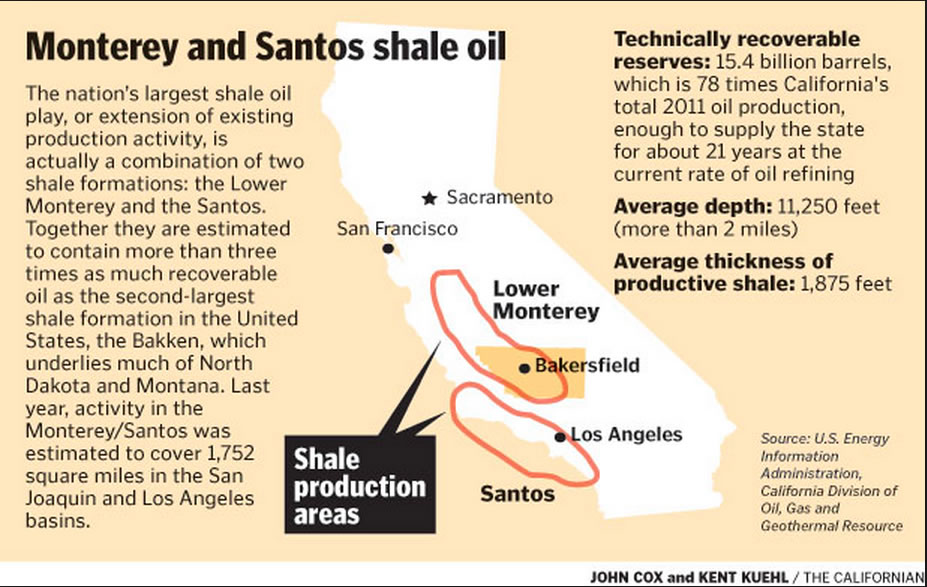

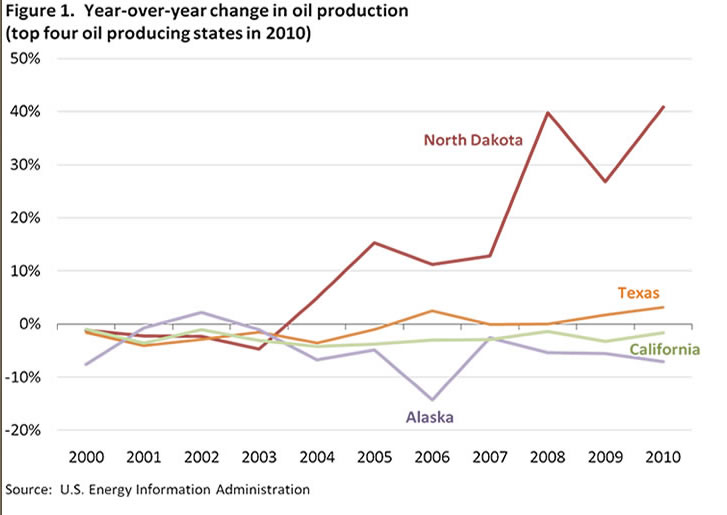

The key story is new technique of extracting oil from shale in the US. North Dakota typifies this production. The Bakken field in the Dakota's, and the Eagle Ford field in TX are resulting in a new surge in US oil production. The monterey and Santos shales in California promise to be the largest sources of all.

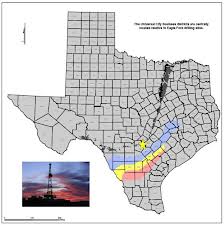

Eagle Ford Shale

The largely untapped Monterey and Santo Shales in Californnia promise to be the largest sources of all.

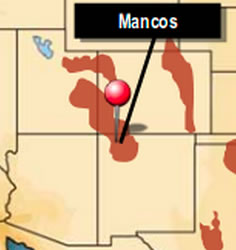

Other shale plays include the Mancos shale in the San Juan Basin in New Mexico and Colorado.

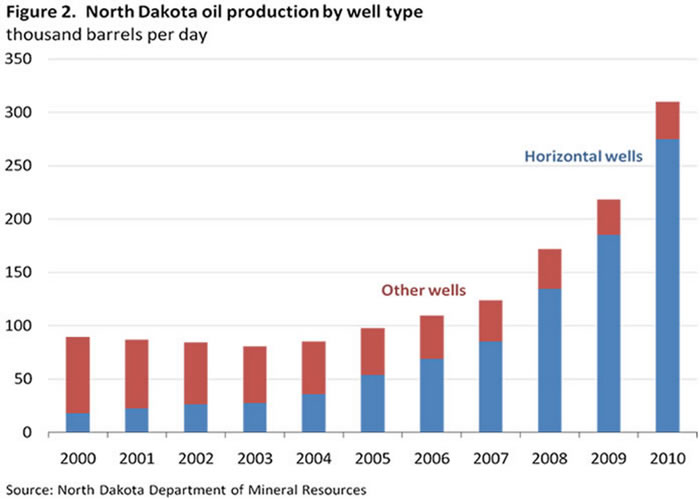

As can be seen by the blue portions of the bars, horizontal wells are taking over.

Further, the increase in production brought about by fracking and horizontal drilling is the order of 40%

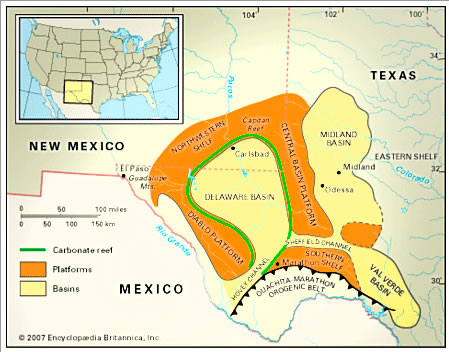

A second area is new productivity is in Texas and New Mexico.

South America

Venezuela

Brazil

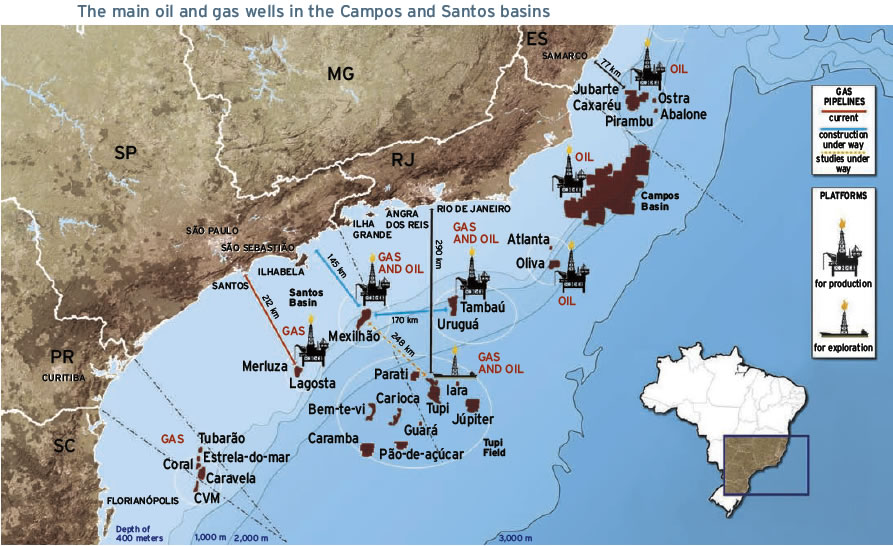

Massive finds out in the Atlantic hold potential for Brazil being an oil exporter of great significance - if it chooses to be.

Further out into the Atlantic, additional discoveries are being made. The Santo Basin where the famous Tupi oil field is, and many other is located off the continental shelf. A drilling ship and the geology described below indicate the massive extent the effort necessary to mine these fields.

Further out into the Atlantic, additional discoveries are being made. The Santo Basin where the famous Tupi oil field is, and many other is located off the continental shelf. A drilling ship and the geology described below indicate the massive extent the effort necessary to mine these fields.

The extraordinary means needs to extract this new oil is no better exemplified than by the Brazilian effort to mine the oil under the salt layers of the Atlantic ocean.

Apart from the open ocean, the depth of the oil, 6000 meters, the very high temperatures at that depth, there is the added issues of drilling in the saline layer where the well bore caves in very rapidly so the pipe must get down in place as fast as a possible.

Europe

Here the big news, still unfolding, is shale oil.

China

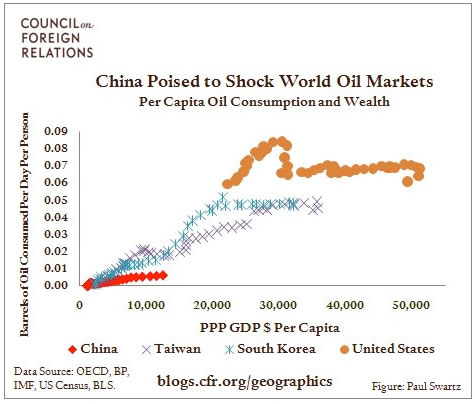

China's need for more oil is actually hard to imagine if we believe that as people move from the countryside to the cities, means that they will become a middle class society. If so, they will want to have TV's, refrigerators, and cars. Since it is projected that 300,000,000 of the 1.4 billion Chinese will move into the cities in the next ten years, it is possible that the number of barrels of oil consumed will start to look like that consumed in the US (as we have 300 million). The plot below shows our consumption in gold, that of south Korea, Taiwan and China's current consumption in red, as a function of the GDP per capita. It is clear that a lot more oil is going to be used if cars remain dependent on gasoline. China will need more than 10 times as much oil as they use today for this 1/4 of the Chinese population. We currently use 1/4 of the total supply of oil in the world. Where is all of this oil going to come from, and how is the earth going to deal with such a huge increase in GHG?

The Chinese do have the possibility of finding oil in the form of shale oil. The map below indicates areas where shale oil may be found.

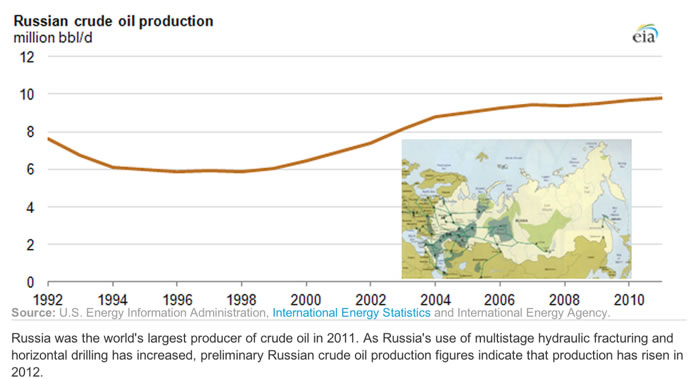

Russia

Russia produced more oil in 2011 than any other country, including Saudi Arabia. Conventional wells have a long way to go, but fracking and horizontal drilling is increasingly becoming important. Fracking isn’t just for shale. In Russia, producers are importing techniques from the U.S. to squeeze billions of dollars of extra oil from Soviet-era fields. TNK-BP, Russia’s third-largest producer, will use hydraulic fracturing combined with horizontal drilling in almost half the wells it sinks this year, a sixfold increase in just two years, the company said. OAO Rosneft (ROSN), OAO Lukoil (LKOH) and OAO Gazprom Neft have similar plans. Used in Russia, producers are recovering 15 percent more crude from aging deposits.

Enhancing production from decades-old fields is needed to maintain Russia’s crude production above 10 million barrels a day for a fourth year, a figure that surpasses Saudi Arabia and the U.S., said Cliff Kupchan, an analyst at Eurasia Group. Apart from the Russian state, which gets half its revenue from oil and gas, the other winners are suppliers of people and equipment to frack wells including Schlumberger Ltd. (SLB), Weatherford International Ltd. (WFT) and C.A.T. Oil AG.

The use of the technique is growing fast. Lukoil didn’t use fracking in a horizontal well in Siberia until 2011, a company official said. Since then it’s undertaken 215 such wells, adding about 19 million barrels of production. Lukoil plans fracking in 450 horizontal wells over the next three years. TNK-BP, which is being acquired by Rosneft, plans 102 horizontal wells with fracking this year, double last year’s number and almost half of all the wells it’s drilling, the company’s press service said. In time, fracking and horizontal drilling in Russia will spread from rejuvenating older fields to developing unconventional reserves. The Bazhenov shale, a layer of rock the size of France that lies underneath Siberia’s producing fields, may hold more oil than Saudi Arabia, according to Russia’s subsoil agency. The geology is similar to North Dakota’s Bakken shale, where production has more than doubled in two years to 700,000 barrels a day, data compiled by Bloomberg show.

New Zealand

New energy finds require fracking, but there is an enormous quantity of oil and gas in the circled area, rivaling or outdoing the Bakken in the US.

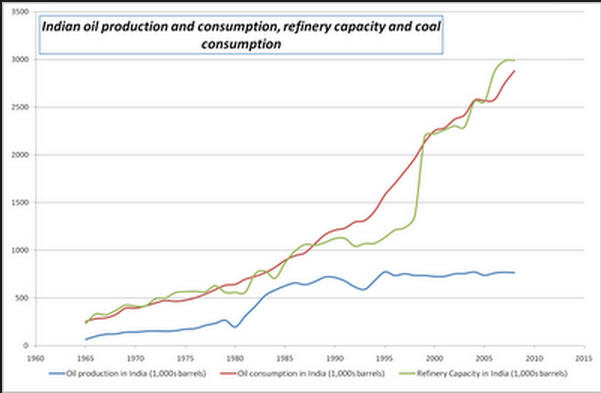

Asia other than China

Outside of China, Malaysia has great potential. India is a sleeping energy giant.

An idea of the difficulties of getting oil in this region is in the dispute between Exxon Mobil and Kazakhstan over the vast Kashagan oil field.

" ExxonMobil and its partners, Shell, Total, ConocoPhillips and Japan’s Inpex, fought tooth and nail ten year ago to be included in the development at Kashagan, one of the dwindling number of “elephant” oilfields left in the world. However, the project that allowed the majors to book huge additional oil reserves, has turned out to be a headache for all concerned. Kashagan is difficult and dangerous to develop – its oil lies in high pressure reservoirs in shallow waters of the Caspian Sea that are infested with shifting blocks of ice in the winter months. Environmentalists say it would be best to leave the field alone. Bankers have raised questions about the astronomical $137bn estimated cost of the development – the most expensive industrial projects ever undertaken. Progress at Kashagan has been disrupted by repeated disputes with Kazakhstan over inflated costs and delays. In the latest row, the Kazakhs have refused to approve the second phase of the development designed to boost production to 1m b/d, citing problems with the timetable and bill. After ten years of work and no oil production to show for more than $20bn of investment it is hardly surprising that the oil majors are growing disheartened at Kashagan."

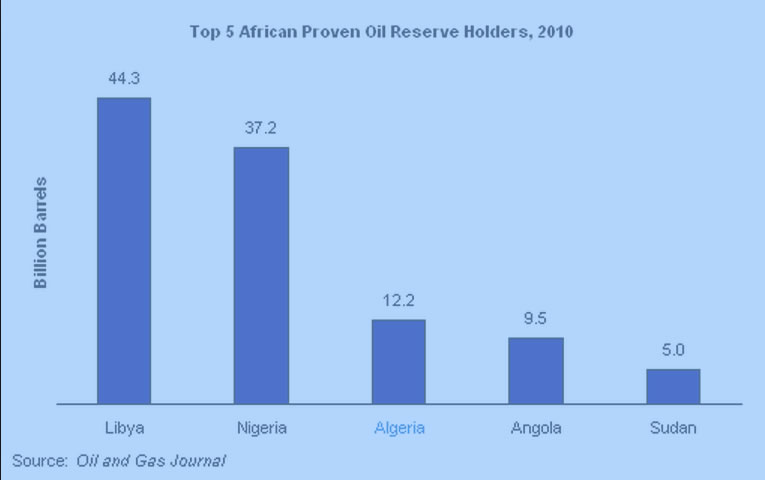

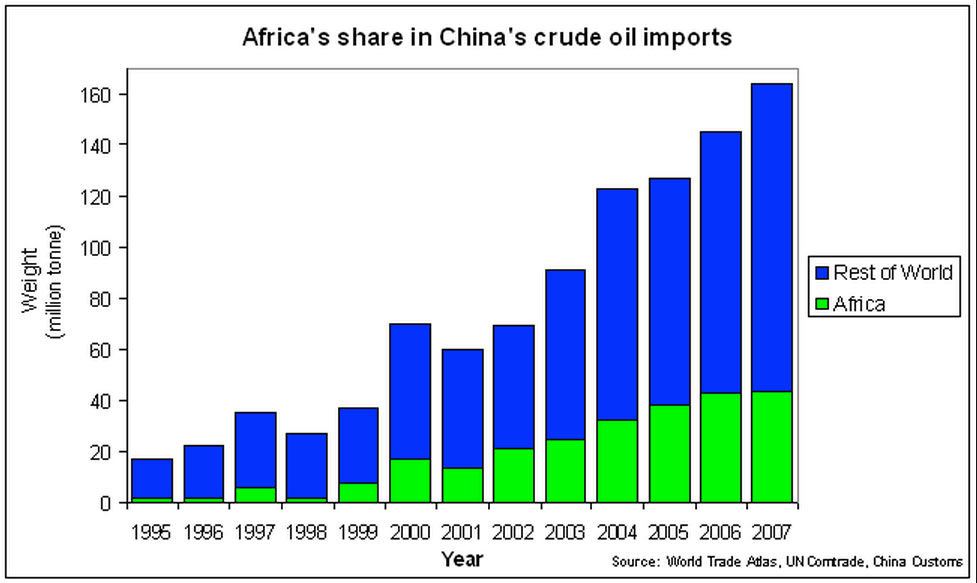

Africa

Very large potential. Nigeria and Ghana are already producing major amounts.

The five largest producers are shown below.

An important customer is China.

2. Pollution from drilling and transporting oil

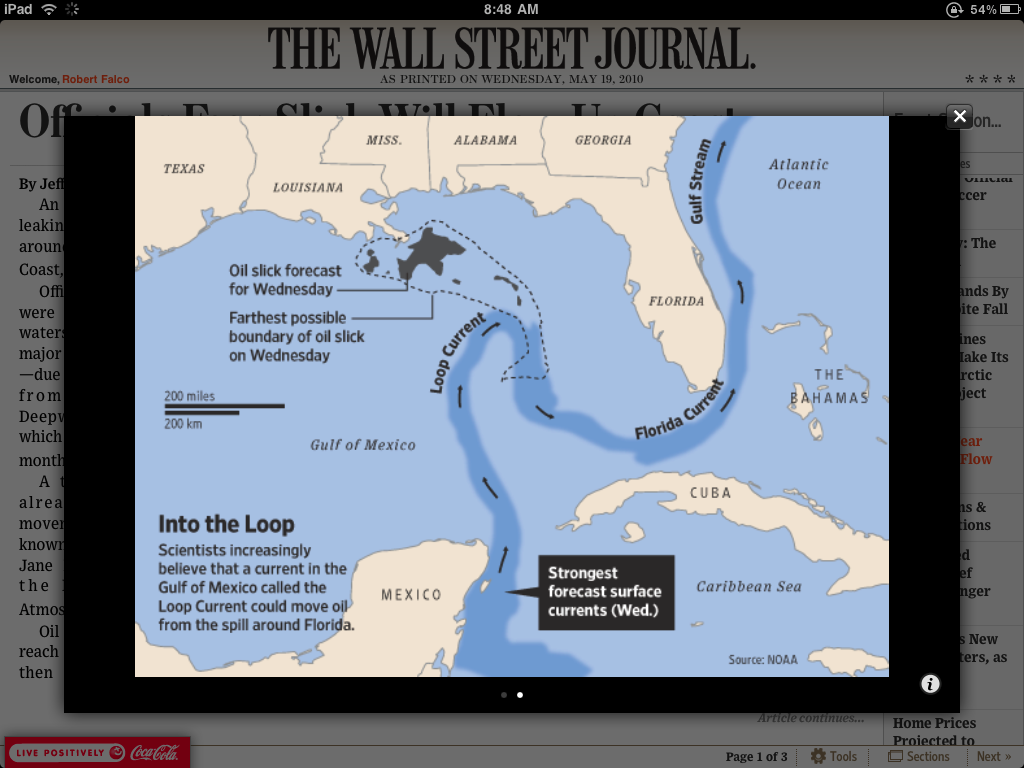

BP oil spill in the Gulf of Mexico, Spring 2010. Tidal currents in the Gulf of Mexico captured the oil (spill originated in the black region) and carried it all the way up the eastern coast. The long range damage is often not considered.

A wave forming on a Florida beach carrying the oil from the above BP oil spill.

Russian oilfield in 2009.

Pollution from the overvalued price of oil

The value of oil is so much higher than that of natural gas that when companies frack for oil, all of the gas that is released first is burn 't off.

Pipeline leaks

The pipeline below has a serious leak (look at about 1/2 of its length). Pipeline leaks are quite common. Mass balancing systems are very adept at providing immediate notification of large ruptures, however approximately a 1% variance is the smallest they can detect. For a pipeline moving 100,000 barrels per day (bpd) that means a leak of 1,000 bpd; for a 250,000 bpd line that equates to 2,500 bpd. Remember, the Keystone pipeline is slated to transport 750,000 barrels per day. Can we really accept leaks of this magnitude going unchecked?

Leaks are so important that it is considered, by the oil companies, that spending 10 million dollars to inspect every 400 miles (of hundreds of thousands) is economical.

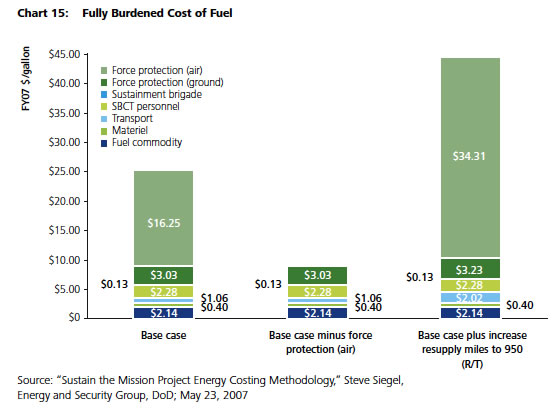

Cost of fuel for our military in Afghanistan

Protecting fuel convoys from the ground and air costs the DoD upward of 15 times the actual purchase cost of fuel, depending on the level of protection required by the convoy and the current market prices of the fuel commodity.

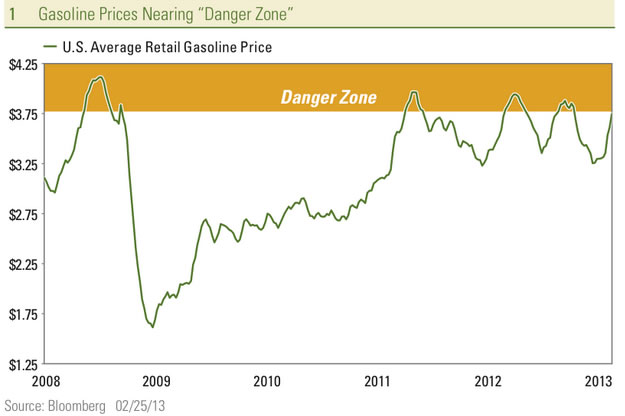

Fuel costs grow exponentially as the delivery distance increases or when force protection is provided from air. The following chart illustrates the fully burdened costs of fuel and shows how high the cost is to protect and transport this fuel to its final destination, bringing the cost per gallon to almost $45 per gallon, compared to the average cost at the retail gas pump of approximately $3 per gallon in 2009.